Investing During a Pandemic: Use a Stockdale Mindset

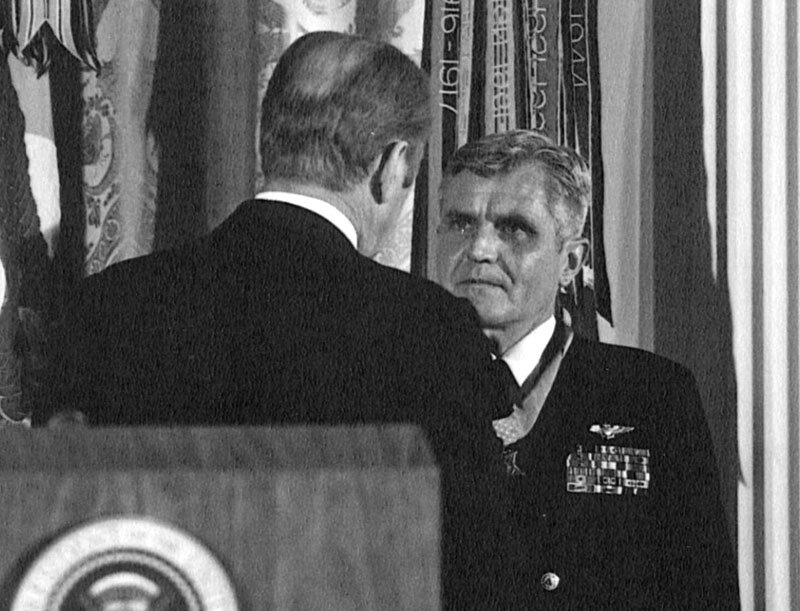

Admiral James Stockdale

Hearing bullets rip through his parachute as he floated to the village below him, James Stockdale knew he was lucky to survive his plane being shot down. However, a throng of irate villagers were awaiting his landing, and he knew this village—solidly behind enemy lines—presented him with a grim reality. His capture was imminent, and thinking the war was going poorly, Stockdale immediately began mentally preparing himself to become the next prisoner of war for “five years…at least.”

Stockdale’s mental fortitude and leadership while in captivity under horrific conditions during the Vietnam War are legendary and have given rise to the concept of the Stockdale Paradox, a mindset for surviving difficult times:

Retain faith that you will prevail in the end, regardless of the difficulties and, simultaneously, confront the most brutal facts of your current reality—whatever they might be.

Stockdale observed that some of his fellow prisoners were blind optimists who always wanted to believe that their captivity and misery would soon end. These prisoners did not fare well. Admiral Stockdale chose to expect pain and suffering, all the while holding onto rock-solid optimism that things would work out in the end. This mentality is what allowed Stockdale to remain a strong leader among his fellow POWs, as well as keep himself mentally fit, and it is the gist of the Stockdale Paradox.

The Brutal Facts

The Coronavirus pandemic is continuing to rush toward us with information changing hourly, keeping everyone’s own reality in a constant state of flux. At times, it feels like we’re still waiting for our parachute to open.

In the early days of the market’s reaction to COVID-19 news, it seemed as if there was a good chance for a relatively quick stock market recovery. Now, the strong measures being taken to “flatten the curve”—and hopefully slow the spread of COVID-19—will shut down significant portions of the economy, and it is difficult to imagine an economic outcome that includes anything other than a recession.

Stockdale’s lessons offer a valuable philosophical framework for the situation we’re now facing, not only as we consider the human impact of the pandemic, but also as a guide for our financial decision making in a time of crises.

The brutal facts of our current financial reality:

Stock prices have fallen dramatically in recent weeks amid uncertainty and panic.

We may be facing an economic recession.

The financial sector is ground zero, and it appears the service sector and others will follow shortly.

It is certainly possible that this situation all works out relatively quickly, as has happened many times in the past, but I think Admiral Stockdale would caution us against hoping for a quick recovery anytime soon. Investors may see bargains and begin supporting stock prices, but with uncertain wages and consumer spending, corporate earnings may flounder leading to an extended bear market. With Stockdale’s survivor mindset, we should accept these poor conditions, yet hold firmly to the knowledge of the market and economy’s incredible resilience and power to adapt, recover, and grow over longer periods of time.

Five-year Mental & Financial Fortress

Before his boots even hit the ground, Stockdale mentally prepared himself for five years of POW captivity (he was actually a prisoner for almost eight years). Stockdale’s timeframe and mindset are valuable guides for what our clients are now facing. Of course, waiting for asset prices to recover is trivial compared to what Stockdale and his companions endured as POWs; however, as we have seen with the “Tech Wreck” and the 2008 global financial crises, market and economic shocks do cause many people a substantial amount of stress, frustration, angst, and regret.

“Remember: we developed financial plans and portfolios that insulate near-term (up to 5 years) financial needs from stock market risks.”

It’s important to note that five years easily covers most of our historical bear markets and recessions, as well as the subsequent recoveries (the Great Depression lasted 10 years, but when adjusting for dividends and deflation, actually offered decent investment returns in the interim).

But I don’t have five years to waste! Five years may seem like a long time, but in our financial planning, we have worked to prepare our clients for these types of scenarios—if we stick with the plan! We have discussed the timeline and priority of financial goals with clients, and regularly check-in regarding any potential near-term expenses. From there, we developed financial plans and portfolios that aim to insulate near-term (up to 5 years) financial needs from stock market risks. Holding cash, money market, and bonds to cover these near-term needs can provide a safe haven pool of assets to draw from in times of stock market stress. Bonds can also experience volatility and have their own risks, but with diversified portfolios of higher quality bonds, they have typically provided a safe ground during stock market downturns.

Admiral James Stockdale receiving the Medal of Honor.

As I’ve written before, the popular “4% Withdrawal Rule” and “bucket approach” are imperfect, but do provide some basic guidance during bear markets. As an example, classic “60/40” stock-to-bond retirement portfolios have approximately 10 years of prescribed 4%-4.5% withdrawals stored in bonds to bridge bear markets in stocks. Most bucket schemes would take a similar approach by breaking down diversified 60/40 portfolio holdings along a timeline that matches more stable and liquid asset with near-term withdrawals and mapping the more volatile stock investments as holdings that don’t need to be touched for a decade or more. These portfolio measures buy time while waiting for the economy and stock prices to recover and go on to reach new gains.

Embracing the paradox of expecting short-term misery, while at the same time planning to reap long-term benefits isn’t a new position—I’ve often recommended it in client meetings—however, when times are good, it’s difficult to understand how quickly things can change for the worse, and how bad it may feel. Similarly, when things look the worst, it’s hard to imagine how they’ll ever improve, and yet they always do. In times like today, remember the Stockdale Paradox: expect a rough road ahead, but with history as your guide, never stop believing that the good days will return.

If you want to learn more about the most notorious bear markets of the past, check out this AMG Funds chart. If you’d like to read more about the recovery timeline, check out the "Time, diversification and the volatility of returns" chart on page 63 of this presentation from JP Morgan.

As always, if you have any questions or concerns about your portfolio, please do not hesitate to contact me.